Top 6 Personal Finance Books

Some members of our team have compiled a list of our top 6 best personal finance books. All of these books are practical and easy to read (without a ton of technical verbiage). Check them out and be inspired in your own financial journey.

Best Personal Finance Books

*All of these best personal finance book descriptions are taken from Amazon.

Let's start with Joe's recommendations:

1. Richest Man in Babylon by George S. Clason

"The Richest Man in Babylon, based on 'Babylonian parables', has been hailed as the greatest of all inspirational works on the subject of thrift, financial planning, and personal wealth. In simple language, these fascinating and informative stories set you on a sure path to prosperity and its accompanying joys. A celebrated bestseller, it offers an understanding and a solution to your personal financial problem. Revealed inside are the secrets to acquiring money, keeping money, and making money earn more money." *

"The Richest Man in Babylon, based on 'Babylonian parables', has been hailed as the greatest of all inspirational works on the subject of thrift, financial planning, and personal wealth. In simple language, these fascinating and informative stories set you on a sure path to prosperity and its accompanying joys. A celebrated bestseller, it offers an understanding and a solution to your personal financial problem. Revealed inside are the secrets to acquiring money, keeping money, and making money earn more money." *

2. Armchair Millionaire by Lewis Schiff and Douglas Gerlach

"Invest my money? Forget it. Who knows which way the stock market is headed? And I just plain don't know how to do it. I'll stick my paycheck in the bank, keep my credit card debt as low as I can, and worry about my financial future when I have some extra money. Besides, there's always Social Security, right?

"Invest my money? Forget it. Who knows which way the stock market is headed? And I just plain don't know how to do it. I'll stick my paycheck in the bank, keep my credit card debt as low as I can, and worry about my financial future when I have some extra money. Besides, there's always Social Security, right?

WRONG, according to the authors of The Armchair Millionaire (and the geniuses behind the Armchair Millionaire Web site), whose philosophy is simple: if your money isn't working for you, then you'll be working a lot longer than you want to. In plain English, Lewis Schiff and Douglas Gerlach, along with real-life cyber-Armchair Millionaires, show you how to save without budgeting the fun out of life, and invest wisely without losing sleep over your portfolio." *

Here are Jo's (aka Lil's) best personal finance book recommendations:

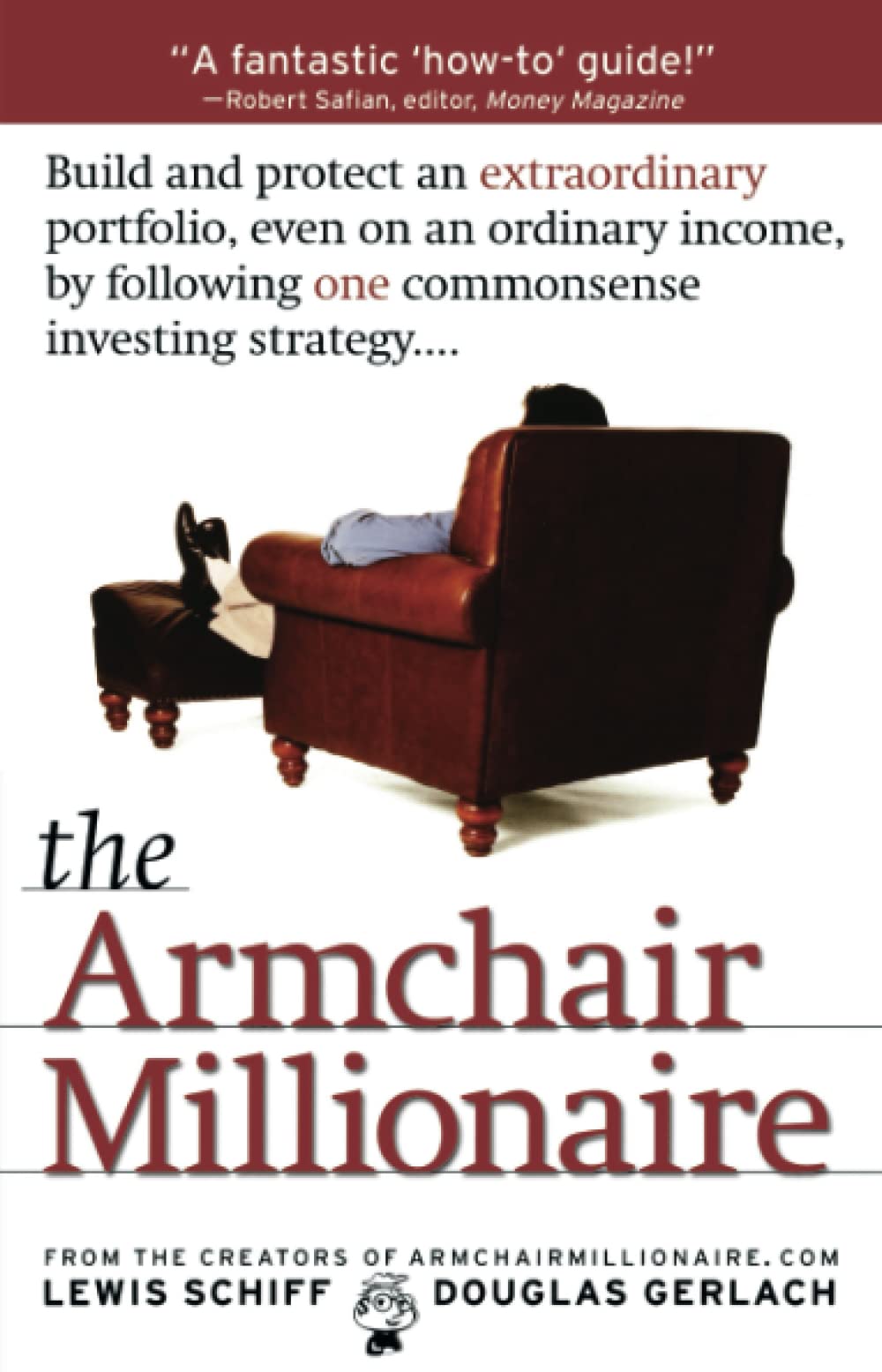

3. The Behavior Gap by Carl Richards

"Why do we lose money? It's easy to blame the economy or the financial markets-but the real trouble lies in the decisions we make.

As a financial planner, Carl Richards grew frustrated watching people he cared about make the same mistakes over and over. They were letting emotion get in the way of smart financial decisions. He named this phenomenon-the distance between what we should do and what we actually do-"the behavior gap." Using simple drawings to explain the gap, he found that once people understood it, they started doing much better.

Richards's way with words and images has attracted a loyal following to his blog posts for The New York Times, appearances on National Public Radio, and his columns and lectures. His book will teach you how to rethink all kinds of situations where your perfectly natural instincts (for safety or success) can cost you money and peace of mind." *

4. The Investment Answer by Daniel C. Goldie and Gordon S. Murray

"What if there were a way to cut through all the financial mumbo-jumbo? Wouldn’t it be great if someone could really explain to us--in plain and simple English--the basics we must know about investing in order to insure our financial freedom?

At last, here’s good news.

Jargon-free and written for all investors--experienced, beginner, and everyone in between--The Investment Answer distills the process into just five decisions--five straightforward choices that can lead to safe and sound ways to manage your money." *

Finally, Mercedes' recommendations:

5. Think and Grow Rich by Napoleon Hill

"Think and Grow Rich has been called the "Granddaddy of All Motivational Literature." It was the first book to boldly ask, "What makes a winner?" The man who asked and listened for the answer, Napoleon Hill, is now counted in the top ranks of the world's winners himself.

The most famous of all teachers of success spent "a fortune and the better part of a lifetime of effort" to produce the "Law of Success" philosophy that forms the basis of his books and that is so powerfully summarized in this one.

In the original Think and Grow Rich, published in 1937, Hill draws on stories of Andrew Carnegie, Thomas Edison, Henry Ford, and other millionaires of his generation to illustrate his principles. In the updated version, Arthur R. Pell, Ph.D., a nationally known author, lecturer, and consultant in human resources management and an expert in applying Hill's thought, deftly interweaves anecdotes of how contemporary millionaires and billionaires, such as Bill Gates, Mary Kay Ash, Dave Thomas, and Sir John Templeton, achieved their wealth. Outmoded or arcane terminology and examples are faithfully refreshed to preclude any stumbling blocks to a new generation of readers." *

6. Rich Dad Poor Dad by Robert T. Kiyosaki

"Explode the myth that you need to earn a high income to become rich.

Challenge the belief that your house is an asset.

Show parents why they can't rely on the school system to teach their kids about money.

Define once and for all an asset and a liability.

Teach you what to teach your kids about money for their future financial success." *

These best personal finance books have each made an impact on our team. If you'd like to find out if our team might be a good fit for your personal financial goals, schedule a complementary introductory call. We look forward to helping you get TO and THROUGH your retirement.

*All of these best personal finance book descriptions are taken from Amazon.

Want help building YOUR Retirement Income Toolkit?